Find out the results and legislation news of the insurance market in February.

Results

- Branch 21 Insurance Returns Surge in Belgium

- Performance Summary of Insurance Services for the 4th Quarter of 2023

Legislation

Results

Branch 21 Insurance Returns Surge in Belgium

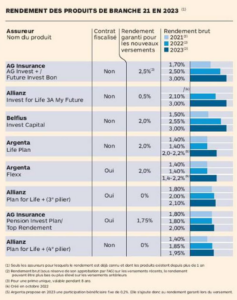

Some branch 21 insurance policies in Belgium yielded returns exceeding 3% in 2023 due to rising interest rates and strong stock market performance, a first in nine years. While certain insurers like AG Insurance, Belfius, and Allianz achieved 3% returns, others are yet to disclose theirs. Tax-exempted contracts saw higher returns compared to taxed ones, reflecting varied tax benefits. Insurers imposed fees and taxes on premiums, and the maximum legal interest rate capped returns at 2%. Some insurers introduced new formulas for higher returns within shorter periods.

Performance Summary of Insurance Services for the 4th Quarter of 2023

The “result of insurance services” totaled 100 million euros, with 60 million euros from non-life insurance and 40 million euros from life insurance. Non-life insurance service results declined by 26% due to increased service charges from storms in Belgium. Life insurance service results fell by 31% due to lower revenues and higher service charges. Financial products and charges amounted to -98 million euros, impacted by interest rate fluctuations and stock market changes. Despite this, the non-life insurance combined ratio remained strong at 87%, with sales increasing by 14% to 549 million euros, while life insurance sales surged by 56% to 685 million euros, driven by successful launches of new structured funds in Belgium.

Legislation

DORA regulation: Financial sector preparation

The financial sector increasingly relies on robust infrastructure and IT services. With growing cybersecurity risks, the European regulation “Digital Operational Resilience Act” (DORA) aims to enhance digital operational resilience, safeguarding financial entities and their clients. Many financial entities are yet to fully prepare for DORA’s implementation, as revealed by an investigation by the Financial Services and Markets Authority (FSMA). FSMA’s recent survey assessed entities’ readiness for DORA, which came into effect on January 16, 2023, with enforcement starting from January 17, 2025. This regulation underscores the importance of managing IT and communication technology (ICT) risks to bolster resilience against cyber threats. While around 50% of entities participated in FSMA’s survey, those yet to respond are urged to familiarize themselves with DORA’s provisions and take necessary steps for compliance.

Sources:

L’Echo, Le rendement de certaines assurances de branche 21 a repassé la barre des 3% en 2023

Assuropolis, Préparation des entités financières à l’entrée en vigueur du règlement européen DORA

Assuropolis, KBC : résultats de l’assurance au 4e trimestre 2023